The marriage of wellbeing and business performance

Following Dr Emma Gillies’ advice on resilience and burnout last month, David Pearson, of chartered accountants and business advisors BDO Hawke’s Bay, explores how personal wellbeing relates to business performance.

Leading and owning a business has always come with risks and rewards. It can bring high levels of personal satisfaction, professional development and growth. For some, it can also improve independence and flexibility while bringing financial and lifestyle rewards. Yet, such roles also present challenges, many of which potentially put your mental wellbeing at risk.

Wellbeing and business performance each receive regular coverage. But what is the relationship between the two among New Zealand’s business leaders, particularly in the healthcare sector?

BDO recently surveyed business owners to glean practical tips, focusing on the ways business leaders can maintain their financial performance to minimise pressures on wellbeing. Of all sectors, respondents from healthcare scored the second lowest for wellbeing. Given the huge and unprecedented challenges of Covid-19, this is not surprising. But it is still disheartening – even before Covid-19, the system was strained with staff shortages and financial pressures combined with an ageing population. That said, there is an air of optimism within the sector and the pandemic has forced many healthcare businesses to digitise or adopt newer technologies and ways of operating, which have had positive impacts.

Financial management is key to wellbeing

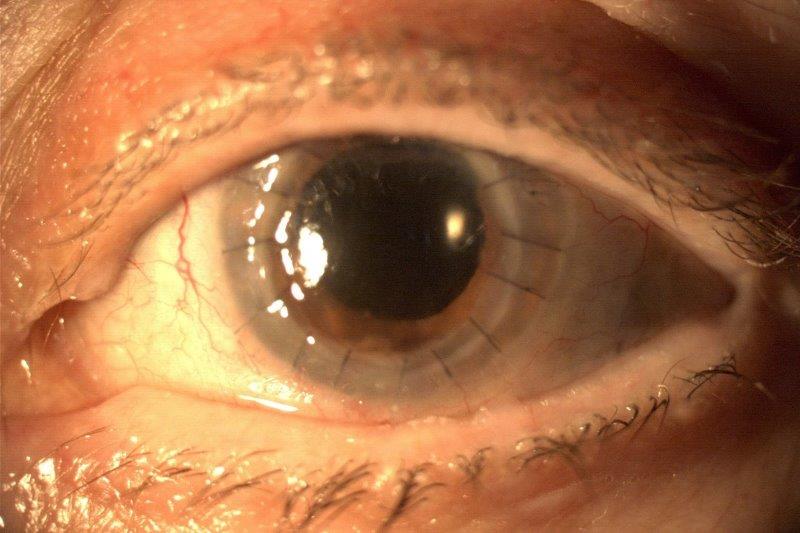

Against a backdrop of Covid-19, inflation and supply-chain challenges, along with unstable economic, political and climate conditions, many businesses are finding it hard to plan. For some, their financial situation is increasingly fraught. With the perfect storm culminating in a cost-of-living crisis resulting in individuals struggling to afford day-to-day necessities, further pressure has been put on businesses, particularly as patients push regular check-ups and preventative eyecare procedures closer to the ‘luxury expense’ column.

Just over one-third (36%) of respondents who indicated they had been feeling less mentally healthy than usual said that business financial concerns were factors. Many specifically mentioned cash flow as a stress point.

Tips for managing financial performance

- Create a solid business plan; return to it regularly

- Stress-test your business plan and financials against various scenarios

- Get a strong foundation in financial literacy

- Maintain strong relationships with your lenders so you can access additional resources when needed

- Set aside time to think strategically. What are the critical success factors for your business and which KPIs will help you get there?

Practical steps for addressing large workloads

- Review telehealth options to help create efficiencies and flexibility for yourself and your staff

- Explore digitisation options to make systems and processes more efficient

- More money has been made available for Māori and Pasifika healthcare providers, plus $488 million was made available in Budget 2022 for investment in primary and community care – explore whether your business qualifies for any of it

- If you’ve got a new telehealth option or are providing a new service, make sure your patients know about it

- Look at options to outsource financial management and other business services – your patients and customers are your number-one priority.

When faced with poor mental wellbeing, the importance of being able to clearly outline, identify and measure your success should not be underestimated; it provides perspective and an overview that is often lost in the murkiness of day-to-day operations.

Most of the business aspects you monitor can typically be changed or improved. Strong forecasting and reporting mechanisms will enable you to stress-test against various scenarios. Think about what business conditions may be like in 3-5 years’ time – taking into account where technology is headed, what’s happening in the wider healthcare sector and where consumer trends are heading – then work out what your business needs to do to thrive in that new environment.

The business leaders who tend to perform best during times of change or disruption are those who understand their finances and their critical success factors. Put simply, you don’t know what you don’t know and a lot of business owners are so wrapped up in keeping their operations going that they don’t necessarily get a chance to think strategically about what success means to them. Setting and monitoring KPIs around those critical success factors is key to maintaining focus and decreasing your likelihood of burnout or workplace exhaustion.

It's often said that small and medium-sized enterprises are the backbone of New Zealand’s economy. However, at BDO, we acknowledge it’s the people running these businesses who are the real heart of the business sector. Only through supporting your wellbeing can you achieve your dreams and drive sustainable economic growth for Aotearoa.

For more on BDO’s wellbeing survey and to access the Wellbeing in Business Healthcare report, see https://www.bdo.nz/en-nz/wellbeing

David Pearson is an advisory partner with chartered accountants and business advisors BDO Hawke’s Bay. He has a special interest and extensive experience in advising the optometry sector. Contact David at david.pearson@bdo.co.nz or visit www.bdo.nz